In its January 2026 World Economic Outlook Update, the International Monetary Fund (IMF) presents a global economy showing surface-level steadiness, underpinned by a complex balancing act of divergent forces. While advanced economies, particularly in North America, are propelled by a surge in artificial intelligence-related investment, the Fund’s revised projections cast a revealing light on the trajectory of Sub-Saharan Africa’s key economies.

Contrary to the narrative of growth driven solely by technological disruption, the IMF has made notable upward revisions for both Nigeria and South Africa for 2026. This adjustment signals recognition of resilient domestic dynamics and reform efforts, even as these economies navigate global headwinds marked by trade policy fragility, geopolitical uncertainty, and a narrowing base of growth drivers elsewhere.

READ ALSO: Djibouti’s Economic Outlook After IMF Review: Ports, Growth and Regional Risks

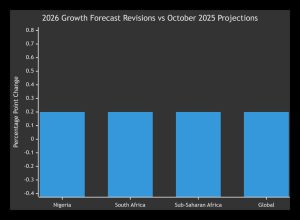

The IMF’s baseline projection anticipates global growth to remain at 3.3 percent in 2026, a modest 0.2 percentage point upward revision from October 2025, before a slight deceleration to 3.2 percent in 2027. This apparent stability, however, masks significant regional and sectoral divergence. The principal engine of growth is identified as a potent combination of soaring investment in artificial intelligence and related technologies, expansive fiscal and monetary support, and broadly accommodative financial conditions. This dynamic is overwhelmingly concentrated in North America and parts of Asia, creating what the Fund explicitly labels a “narrow base of drivers” that renders global growth vulnerable.

Concurrently, the global economy operates under a persistent cloud of downside risks. These include a potential sharp correction in the valuations of AI-focused firms, which could trigger broader financial market contagion and erode household wealth. The report underscores that the current trade policy environment remains fragile, subject to flare-ups that could prolong uncertainty. Furthermore, elevated public debt levels in several major economies present a latent threat to long-term interest rates and financial stability. It is within this complex and potentially volatile international milieu that the revised forecasts for Nigeria and South Africa must be assessed.

Sub-Saharan Africa: A Region of Gradual Acceleration

The IMF’s outlook for Sub-Saharan Africa is one of cautious, incremental improvement. Regional growth is projected to accelerate from 4.4 percent in 2025 to 4.6 percent in both 2026 and 2027, representing a slight upward revision. This trajectory is attributed not to the technology-driven boom witnessed elsewhere, but to sustained macroeconomic stabilisation and ongoing structural reform efforts in several key economies. The region’s growth narrative remains distinct, less influenced by volatile global tech investment and more dependent on domestic policy consistency, commodity market dynamics, and the gradual deepening of intra-regional trade linkages.

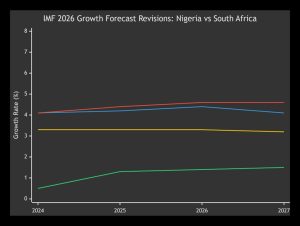

Nigeria: Upward Revisions on Domestic Reforms and Policy Support

For Nigeria, the IMF’s updated assessment reflects measured optimism. The forecast for 2026 growth has been revised upward by 0.2 percentage points to 4.4 percent, with a further 0.1 percentage point increase for 2027, placing it at 4.1 percent. The 2025 estimate also sees a 0.2 percentage point uplift to 4.2 percent. These revisions are significant within a global context where many forecasts remain stagnant or face downward pressure.

The drivers behind this improved outlook are primarily domestic. The IMF points to the impact of stimulus measures and additional lending from policy banks designed to spur investment. Furthermore, the report implicitly acknowledges the role of ongoing, though often challenging, macroeconomic reforms aimed at stabilising the currency and fiscal position. While Nigeria benefits less directly from the AI investment surge, its growth revision suggests resilience built on internal adjustments. However, the projected deceleration from 2026 to 2027, even at revised levels, indicates that structural headwinds are expected to reassert themselves, underscoring the need for sustained reform momentum.

South Africa: A Modest but Meaningful Recovery Path

South Africa’s economic narrative, as per the IMF update, is one of fragile recovery, gaining a firmer footing. The Fund has revised its 2025 growth forecast upward by 0.2 percentage points to 1.3 percent, with a corresponding 0.2 percentage point increase for 2026, now projected at 1.4 percent. The 2027 forecast remains unchanged at 1.5 percent. Although these growth rates remain modest compared to the regional average, the consecutive upward revisions signal a breaking of negative cycles and an endorsement of recent policy steps.

This gradual improvement is likely attributed to incremental progress in addressing the country’s most binding constraints: ongoing reform of the energy sector to alleviate load-shedding, gradual improvements in port and rail logistics, and a commitment to fiscal consolidation. The IMF’s adjustment suggests that these efforts, however slow, are beginning to translate into tangible, if limited, growth dividends. South Africa’s story exemplifies an economy climbing back from a low base, where marginal gains represent important victories in stabilisation.

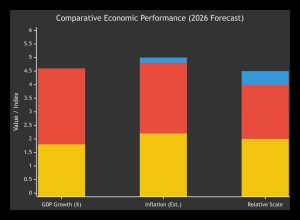

Placing Nigeria and South Africa side by side reveals two distinct models within the African growth landscape. Nigeria’s higher growth trajectory, even when revised, is characteristic of a large, demographic-heavy economy with significant, albeit volatile, commodity linkages. Its revisions stem from direct policy interventions and banking sector activity. South Africa, in contrast, represents a more industrialised and financially integrated economy recovering from a prolonged period of stagnation through structural repair of core infrastructure and state-owned enterprises.

Both nations, however, share profound vulnerabilities highlighted indirectly by the IMF’s global risk assessment. Elevated public debt levels, a concern raised for advanced economies, are equally pressing here and could constrain fiscal space for future development spending. Furthermore, both economies remain exposed to sudden shifts in global financial conditions. A sharp tightening, possibly triggered by a market correction in AI stocks or a sovereign debt crisis elsewhere, could precipitate capital outflows and currency pressures. Political and policy uncertainty, another global risk, remains a domestic factor that could undermine investor confidence and derail reform programmes.

Strategic Implications and Forward Outlook

The IMF’s revised forecasts for Nigeria and South Africa offer a nuanced narrative. They are not a story of breakout, technology-fuelled growth, but rather one of resilience and gradual improvement achieved through domestic policy recalibration. For policymakers, the message is twofold. First, the revisions validate the direction of recent reforms and should incentivise their deepening and acceleration, particularly in areas of fiscal sustainability, energy security, and business climate enhancement. Second, the persistent downside risks dominating the global outlook serve as a stark warning against complacency.

The path forward requires a dual focus. Internally, maintaining discipline on reforms is paramount to solidify the foundations of growth and build buffers against external shocks. Externally, navigating the fragile global trade environment and potential financial market volatility will demand prudent macroeconomic management and the accumulation of foreign exchange reserves where possible. Ultimately, while the upward revisions for 2026 provide a welcome respite and a platform for optimism, the true test for Nigeria and South Africa will be their ability to translate this incremental momentum into sustained, inclusive, and diversified growth that withstands inevitable shocks in an increasingly divergent and uncertain global economy.