By Aleksa Burmazović

Introduction

COVID-19 had dire economic consequences for many countries in Africa

Many marginal Special Economic Zones (SEZ) programs, which were already underutilized prior to the pandemic, could fail.

Other countries will use COVID-19 to reinvent and reinvigorate their economic zones.

Countries across the African continent now hope that a new wave of SEZ projects can help them mitigate the damage caused by the global economic slowdown.

This report explores how SEZs in different African countries have reacted to the COVID-19 pandemic, and how the pandemic will shape the future of SEZs.

SANDF Forces enforcing stay-at-home measures in Cape Town in May 2020.

SANDF Forces enforcing stay-at-home measures in Cape Town in May 2020.

Source: The Conversation

Effects of COVID-19 on the African Economy

The pandemic will seriously hurt economies across the African content.

The World Trade Organisation (WTO) expects world trade to fall by 13-32% in 2020. Africa’s exports represent an estimated 2.6% of total world exports in 2018, based on statistics from the International Monetary Fund’s (IMF) World Economic Outlook Database. According to this data, this would mean a 2020 loss of export earnings for the African continent in excess of $500 billion.

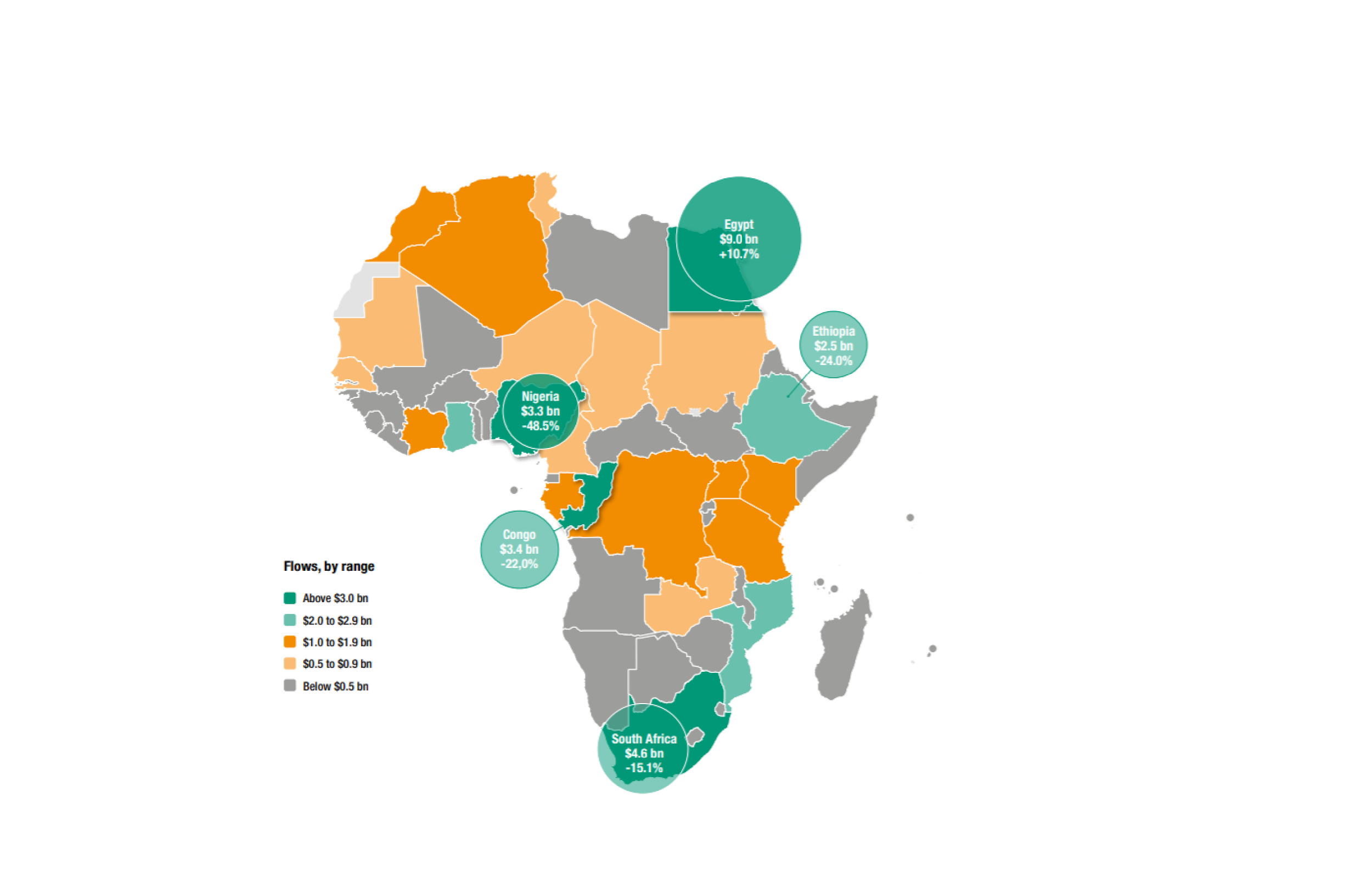

A World Bank report predicts Africa’s continental GDP will contract 2.1-5.1% in 2020. This would be the first negative result for the continent in over 20 years and maybe the sign of a coming recession for Africa. There’s more bad news for foreign direct investment (FDI) into the region, consisting of a two-pronged attack of COVID-19 and low commodity prices.

It is estimated that around 90% of Africa’s trade takes place via ocean shipping, most notably through Durban, Mombasa, Suez, Dar es Salaam, Tangier, and Lagos.

Logistics bottlenecks have been caused in many of these ports, by preventative measures against COVID-19. What this means is that ships must lay at anchor for weeks or even months before being allowed to dock, and even then crew is not allowed off the vessels. This makes ports operate at part-capacity at best, leading to a major slowdown in trade.

Although leading to lower efficiency, these steps were necessary in slowing infection spread. Rising shipping prices, however, lead to various goods no longer being viable for import or export through African ports. This will mean a reduction in the role of intercontinental trade for Africa.

Inbound vessels from China have been failing to dock at the port of Mombasa, one of Africa’s largest. Source: EastAfrican

Inbound vessels from China have been failing to dock at the port of Mombasa, one of Africa’s largest. Source: EastAfrican

African trade is going Regional

African economies dependent on international Foreign Direct Investment (FDI) flow will have to now rely on their local neighbours for trade.

A combination of factors will cause international FDI flows to continue slowing down. COVID-19, commodity and tariff trade wars, as well as US military withdrawal worldwide, will decrease international trade.

This is problematic because intra-regional trade among African countries only accounts for 17% of total trade in the continent.

A disruption in international trade routes as a result of COVID-19 will have disproportionately heavier economic consequences on Africa than other more regionally integrated trading powers, such as the EU or USA.

UNCTAD reports that low oil prices will create a noticeable dent in FDI for some of Africa’s largest economies, particularly Angola, Nigeria and Egypt. Smaller economies which had a higher FDI to GDP ratios, such as Congo-Brazzaville, Mozambique and Gabon, will feel the contraction in FDI caused by COVID-19 even more than their neighbouring countries.

UNCTAD’s report outlines that 2019 was one of the worst years for African FDI in the past 15 years. Source: unctad

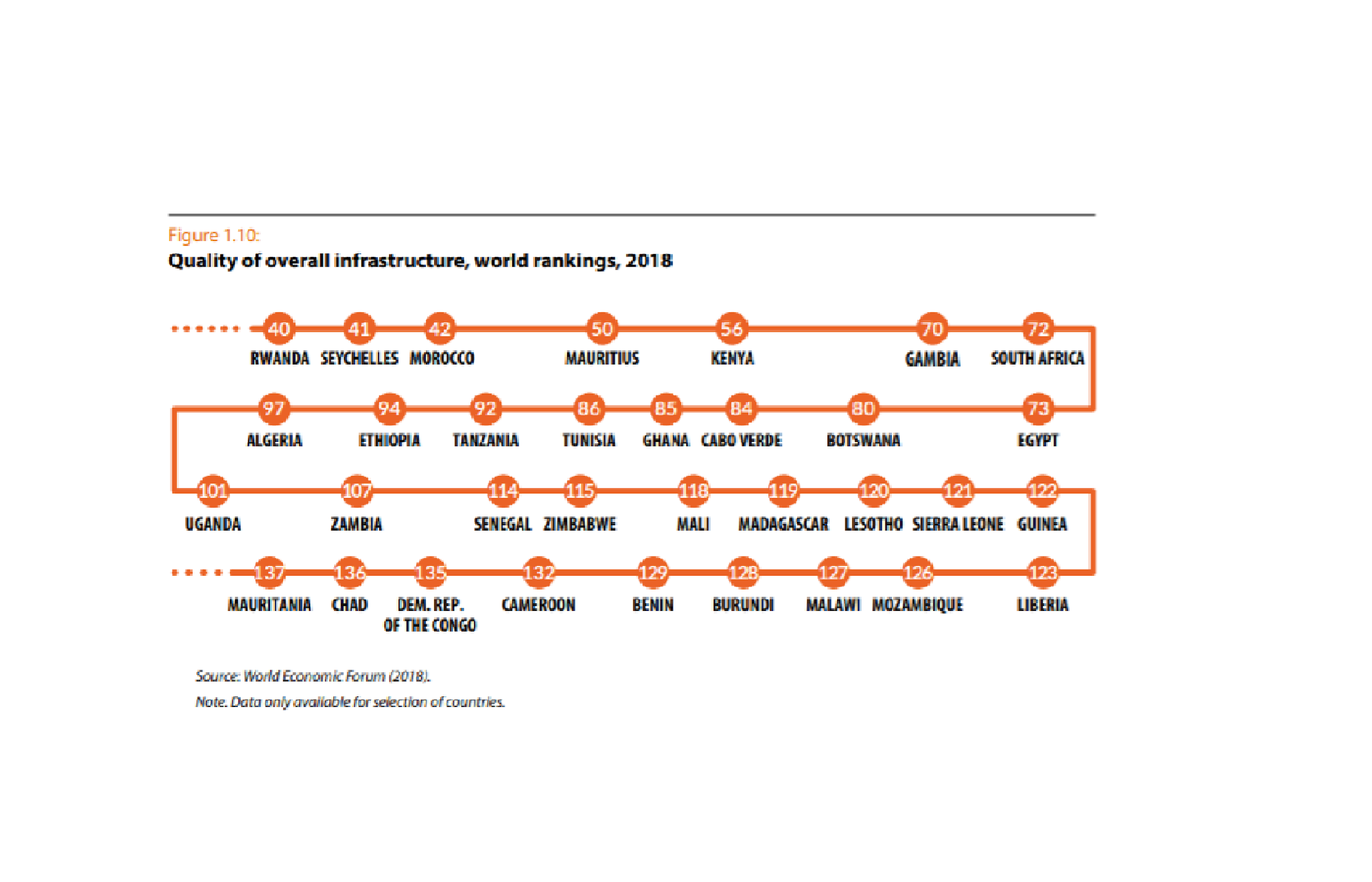

The overall level of infrastructural connectivity among African countries is often inferior to their respective connectivity with cross-oceanic neighbours.

As has been mentioned in an Adrianople Group paper: sending a 20-foot shipping container from Shanghai to Mombasa by sea costs just over $500. Sending the same container from Mombasa to Kigali costs in excess of $3000.

This suggests lower future investment in African land infrastructure.

In the poorer African countries, economic growth is strongly correlated to the strength of ground transportation infrastructure. In countries such as Cameroon and the Central African Republic, The percentage of roads which are paved in countries like Cameroon and the Central African Republic barely cross the single-digit mark, and desperately need more investment. Navigable rivers are something of saving grace, but their seasonal shifts often make them treacherous for long-term planning.

The ratings of infrastructure quality worldwide. Countries like CAR, Guinea-Bissau and others are omitted. Source: UNECA

The ratings of infrastructure quality worldwide. Countries like CAR, Guinea-Bissau and others are omitted. Source: UNECA

SEZs in the African Common Market

Some see a silver lining in the African Continental Free Trade Area (AfCFTA), a continent-wide free-trade area which is the largest in the world in terms of the number of participating countries since the formation of the WTO.

The AfCFTA will soon be operationalized, meaning that trade among African countries will be more streamlined than ever before.

AfCFTA, for all its similarities to the European Union, is noticeably different in that it does not have restrictions on SEZ-style “state aid programs” to its members. The EU does, in the form of regulatory harmonization, require SEZs to fall within certain parameters specified by the EU. The AfCFTA has no such restrictions written into its founding document.

The annex to the AfCFTA founding treaty only outlines how and when products are specified to originate within the AfCFTA for customs purposes – all other regulations and advantages conferred upon zones are allowed in the spirit of industrialization and development of the African continental free trade area.

Furthermore, the AfCFTA advocates the creation and deepening of SEZ policy in all its member countries in order to boost intra-African trade. A consensus model is expected to take place in AfCFTA discussions, where members pool resources and best practices in order to maximize the comparative advantage of each member country’s zone programs.

This leads to spirits being high as many of Africa’s up-and-coming countries are projecting bold development programs for the coming decade – many of them through special economic zones. We’ll examine several case studies, but this is by no means an exhaustive list.

Kenya: Buy Kenyan, Build Kenya

Kenya’s economy has suffered significantly from the global economic downturn.

The Kenyan government now hopes to revitalize its existing SEZ program to stimulate its economy and mitigate losses.

Kenya’s economy is the largest in East Africa and is deeply integrated into global supply chains. Over 65% of its exports, and over 70% of its imports, come from non-African trading partners.

To take advantage of its global integration in supply chains, the Kenyan government is implementing the Buy Kenya Build Kenya (BKBK) initiative. The purpose of this initiative is to “improve total factor productivity, improve on quality and standards, and ultimately raise competitiveness for locally produced goods and services.”

As a part of this initiative, the Kenyan treasury has issued a stimulus package of KSH 600 million ($5 million) for purchasing locally assembled vehicles. Another strategy is the “Kenya Industrial & Entrepreneurship Project” which is planning on further stimulus for the SEZ sector, to the tune of $13 million.

More stimulus is also in the works for Naivasha’s SEZ and textile park, the Dongo Kundu SEZ on the coast. Several other types of leather and textile parks are also expected to receive stimulus funding.

President Uhuru Kenyatta: “We must buy Kenyan and build Kenya” Source: YouTube

President Uhuru Kenyatta: “We must buy Kenyan and build Kenya” Source: YouTube

The government is in the process of rolling out Finance Act 2019, with the goal of making Kenyan-made goods and services more competitive regionally as well as the development of a Kenyan Coast Guard to ensure the safety of their waters and Exclusive Economic Zone (EEZ). These developments are observed at the same time as the COVID-19 crisis and pullback of US Navy presence from the Indian Ocean.

SEZs in Kenya will be bolstered with the tools of stimulus, standardization and regional infrastructure connectivity, which is to be expected of a large and ever more mature market such as Kenya’s.

South Africa: A Long-Needed Pivot

South Africa’s economic decision-makers are particularly worried about this crisis eroding their already ailing manufacturing base.

SA’s mining and automotive exports are primarily aimed at South and East Asian markets, and a disruption of this relationship (particularly in the long term) would lead to a noticeable slowdown in economic activity.

South Africa’s largest SEZs such as Coega and Richards Bay are geared toward manufacturing exports into these regions, and those zones that focused on intra-African trade such as the Musina-Makhado zone in the northern Limpopo province have had trouble gaining traction.

Coega, South Africa’s largest IDZ, is in Port Elizabeth. Source: Aicontact

Coega, South Africa’s largest IDZ, is in Port Elizabeth. Source: Aicontact

As a solution to this appearingly systemic issue, the leadership of SA has come up with the Industrial Policy Action Plan (IPAP) which holds some of the steps necessary to re-ignite the industrial base of the country and, which is key, maintain sustainable employment levels for South Africans. The already existing Industrial Development Zones were supplanted by a newer 2014 SEZ law, allowing for a wider set of incentives to be used.

This adjustment of the SEZ model from the previous IDZ paradigm is a welcome one, as the regulation allows for a wider selection of special regulations and a more bottom-up approach to creating zones, which will allow them to benefit from the local context and knowledge economic leaders from the various provinces hold.

Nigeria: The Resource Curse

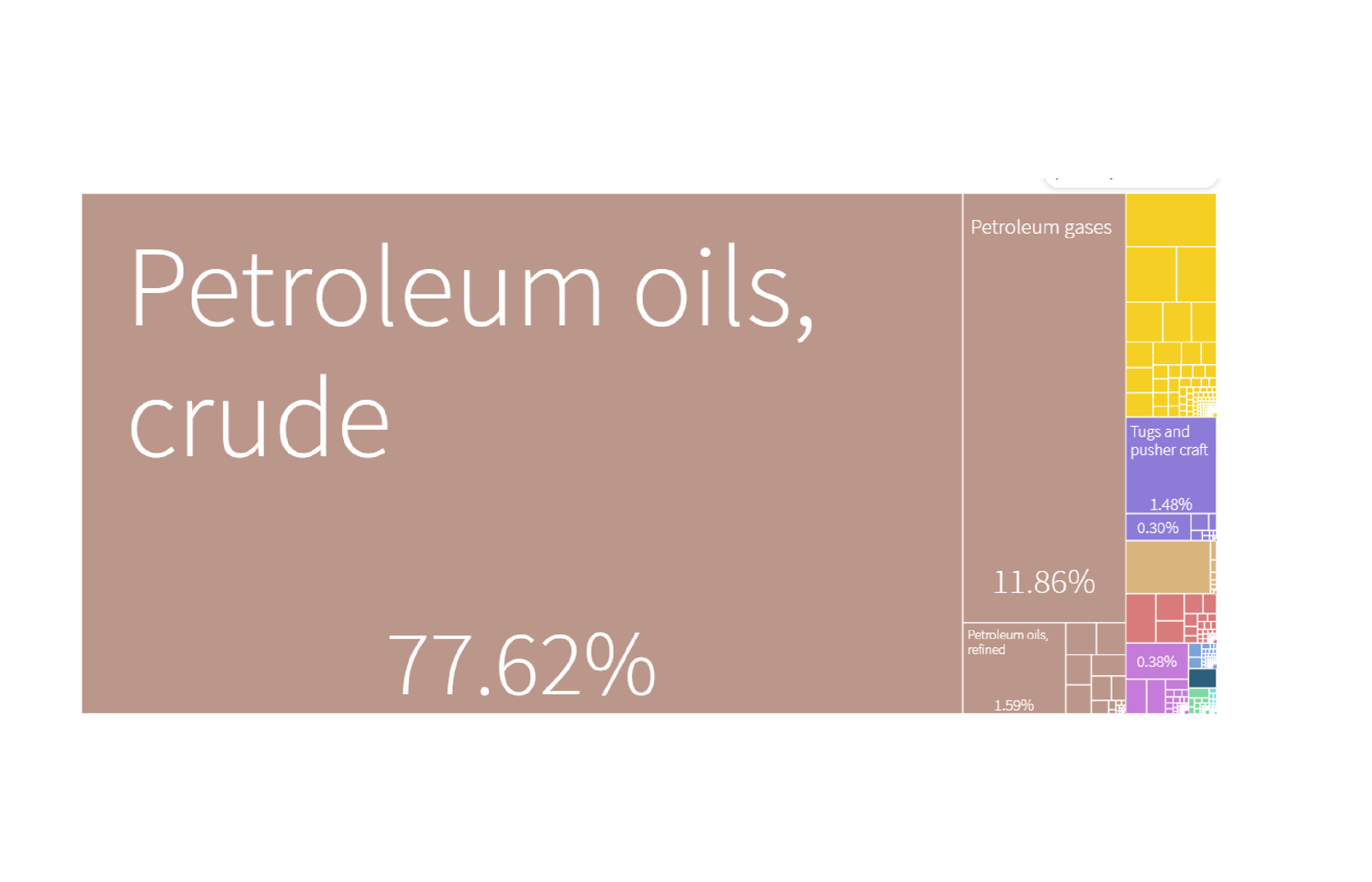

Nigeria’s petroleum sector is negatively affecting their ability to create effective SEZs because of government in-fighting and a lack of diversification.

Nigeria’s over-reliance on the oil and gas sector is palpable in its zone space – notably, there are 2 zone authorities in the country: the Nigerian Export Processing Zones Authority (NEPZA) and the Oil & Gas Free Zones Authority (OGFZA).

Few if any countries have a sectoral split this explicit, and it is notable that the advantages offered by one differ from the other. NEPZA and OGFZA do not list each other as cooperating partners, and even have something of a rivalry in influencing the Nigerian national Assembly for zone authority consolidation.

90% of Nigeria’s exports are petrochemical in nature, and few of them are value-added products. Source: Atlas

Another notable problem with Nigeria’s zones is infrastructural: there have been significant downtimes in electricity availability for the zones as for the rest of the country. So large are they, in fact, that an ADB estimate places the cost of these blackouts around 3% of Nigeria’s GDP – over $11 billion per year.

It appears that Nigeria’s zone sector is not as responsive as it should be to the clear trade regionalization trend detected by other large African economies. A combination of poor infrastructure and superstructure lead to an economy dependent on FDI, and low oil prices threaten that Nigeria may not fare well in the macroeconomic environment of 2020. This would continue the nation’s wave of falling GDP since the oil price spike in 2014.

Morocco: The Bridge between Africa and Europe

Morocco’s advantages lie with their proximity to the European Single Market – regionalization doesn’t mean trading exclusively within a single continent.

The council of the European Union had given its approval for Morocco’s reforms of its business and free zone regime near the end of April this year. As the Kingdom is still on the EU’s “Grey List” of potential tax havens, it is in the interest of the African nation to engage in reforms that will remove them from the list and attract more business from their European counterparts who already comprise most of their foreign exchange market, particularly Spain.

One of Spain’s enclaves on the African continent is Ceuta in Morocco – which used to be classified as a free port before Spain’s joining the EU. The Kingdom of Morocco closed the border crossing between the towns of Fnideq and Ceuta in 2019, but is now working on the “Oued Negro Free Zone project”.

This would be an economic zone near Ceuta, approved by Head of Government Saad Eddine El Othmani. In the legal document outlining the project, it is organized as a joint-stock company that hopes to capture value-added activities in the M’diq-Fnideq prefecture.

A poster for phase 1 of the zone, which is still in the early stages of construction. Source: Atalyar

A poster for phase 1 of the zone, which is still in the early stages of construction. Source: Atalyar

It is important to note that this zone will primarily benefit from its proximity to the Ceuta port – specifically, goods from the Fnideq zone will be able to enter the European Common Market before they even leave the continent of Africa. Combining that with value-add industries and proximity to resource-rich countries in the region such as Mali and Mauritania is a combination that allows for powerful regional integration.

Cabo Verde, Tanzania, Gabon: Small Economies, Big Potential

Smaller economies, particularly those with a high FDI to GDP ratio, have to be bolder and more creative with their SEZ programs.

African countries which have been particularly hard-hit by the economic downturn have been looking toward SEZs as a strategy to reconnect with regional markets. As many countries decided on their budgets in Q1 and Q2, it is notable that a significant number of them include a budget for investment and export promotion, particularly with Zones.

For example, Tanzania’s Kurasini Export Processing Zone and Bagamoyo Port seem to be the largest SEZ projects currently underway in the country – however, they seem to be hoping for a slowdown in COVID-19, after which they would be able to recapture the now-weakened East Africa-East Asia trade relationship. This strategy shows signs of high risk and high reward, which can be absorbed by an economy of Tanzania’s size, but not other smaller competitors.

Cabo Verde has had unanimous parliamentary support for its maritime SEZ of São Vicente. The zone is meant to be a “pilot” for further zones, which would be island-wide and customized for each island’s competitive advantage. This is in line with the Strategic Plan for Sustainable Development 2017 -2021 (PEDS), integrating the SDGs and the principles of the Africa 2063 Agenda.

Elsewhere, Gabon’s Nkok and Owendo zones are facing a challenging situation with cement giants Dangote (from Nigeria) and Ciments de l’Atlas (from Morocco) both setting up shop in the resource-rich Central-African country. This would likely lead to overcapacity in construction materials, such as the one that partly precipitated the Chinese Belt & Road Initiative.

Gabon’s Owendo port is being retrofitted from a primarily bulk focus to a containerized and value-added product model. Source: Owendo

Gabon’s Owendo port is being retrofitted from a primarily bulk focus to a containerized and value-added product model. Source: Owendo

This could lead to projects in Cameroon, CAR, and other regional partners’ infrastructure sector, further empowering regional trade in Africa through SEZs.

Conclusion

The economic turmoil that Africa has and will continue to experience will be particularly hard on the SEZ sector. It is not beyond possibility that many of Africa’s most established SEZs may cease to exist as a result of Subsaharan Africa’s first recession in over 25 years.

Where old models fail, new ones will emerge – Africa’s largest economies, as well as those with a high FDI to GDP ratio, are scrambling to adapt their SEZ policy to a new, more regionalized world trade paradigm. This is due to trade wars, the US withdrawing much of their military presence, and a pullback in Foreign Direct Investment.

This increasingly competitive and challenging environment for Africa’s Zones will mean that many zones may falter and lose their competitiveness, which often comes from their connection to international markets. As unfortunate as this is for the existing zones, it’s a necessary step for a new, more responsive SEZ policy for Africa’s economies.

AfCFTA’s attempt to foster dialogue may be what is needed to avoid a “race to the bottom” scenario with this new wave of zones. The boundless optimism of foreign direct investment into Africa of 5-7 years ago must now cede its place to a sober analysis of best practices and advantages for African economies and how SEZs can help achieve them.

References

- https://www.businessdailyafrica.com/analysis/ideas/Africa-exports-in-coronavirus-gloom/4259414-5557596-3j1quhz/index.html

- https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020

- https://www.worldbank.org/en/news/press-release/2020/04/09/covid-19-coronavirus-drives-sub-saharan-africa-toward-first-recession-in-25-years

- https://news.sap.com/africa/2017/11/about-90-of-imports-and-exports-in-africa-driven-by-sea/#:~:text=Statistics%20indicate%20that%2090%25%20of,grow%20at%20an%20unprecedented%20rate1.

- https://www.reuters.com/article/us-health-coronavirus-east-africa-commer/coronavirus-induced-border-bottlenecks-slow-food-deliveries-in-east-africa-idUSKBN2352E7

- https://www.metalbulletin.com/Article/3925980/Home/African-lockdowns-cause-month-long-delivery-delays-for-copper-cargoes.html

- https://warontherocks.com/2019/03/cost-plus-50-and-bringing-u-s-troops-home-a-look-at-the-numbers/

- https://blogs.worldbank.org/africacan/how-will-covid-19-impact-africas-trade-and-market-opportunities

- https://unctad.org/en/PublicationsLibrary/wir2020_en.pdf

- https://data.worldbank.org/indicator/BX.KLT.DINV.WD.GD.ZS?locations=ZG&most_recent_value_desc=false

- https://www.uneca.org/sites/default/files/PublicationFiles/aria9_en_fin_web.pdf

- https://commons.wmu.se/cgi/viewcontent.cgi?article=2206&context=all_dissertations

- https://www.businessdailyafrica.com/analysis/ideas/Africa-exports-in-coronavirus-gloom/4259414-5557596-3j1quhz/index.html

- https://www.ey.com/Publication/vwLUAssets/Raport_EY_Poland_-_a_true_special_economic_zone/$FILE/Raport-Poland-a-true-special-economic-zone.pdf

- https://au.int/sites/default/files/treaties/36437-treaty-consolidated_text_on_cfta_-_en.pdf

- https://www.tralac.org/documents/resources/african-union/2163-compiled-annexes-to-the-afcfta-agreement-legally-scrubbed-version-signed-16-may-2018/file.html

- https://www.herald.co.zw/afcfta-considers-special-economic-zones/

- https://oec.world/en/profile/country/ken/

- https://citizentv.co.ke/blogs/diaz-2020-2021-kenya-budget-a-short-in-the-arm-for-local-industry-in-advent-of-covid-19-335545/

- https://www.tralac.org/documents/resources/by-country/kenya/576-buy-kenya-build-kenya-strategy-june-2017/file.html

- https://www.industrialization.go.ke/index.php/kenya-industry-and-entrepreneurship-project-kiep/491-background-kenya-industry-and-entrepreneurship-project-kiep

- https://www.businessdailyafrica.com/analysis/ideas/What-s-in-2020-Budget-to-spur-SMEs-growth-and-innovation-/4259414-5576318-d8v5sp/index.html

- https://www.miningweekly.com/article/eskom-sets-up-just-energy-transition-office-as-it-mulls-repurposing-options-for-power-stations-2020-06-25/rep_id:3650

- https://www.globalafricanetwork.com/company-news/special-economic-zones-among-the-paucity-of-realistic-interventions/

- https://www.globalafricanetwork.com/company-news/special-economic-zones-among-the-paucity-of-realistic-interventions/

- https://www.gov.za/sites/default/files/gcis_document/201409/37664act16of2014specialeconzones19may2014.pdf

- https://www.thisdaylive.com/index.php/2020/06/08/operators-hail-malami-adebayo-on-ogfzas-takeover-of-export-free-zones/

- https://www4.unfccc.int/sites/SubmissionsStaging/NationalReports/Documents/187563_Nigeria-NC3-1-TNC%20NIGERIA%20-%2018-04-2020%20-%20FINAL.pdf

- http://documents1.worldbank.org/curated/en/394091575477674137/pdf/Jumpstarting-Inclusive-Growth-Unlocking-the-Productive-Potential-of-Nigeria-s-People-and-Resource-Endowments.pdf

- https://atalayar.com/en/content/new-opportunities-morocco-post-coronavirus-era

- https://northafricapost.com/28881-morocco-in-the-eus-grey-tax-haven-list.html

- https://oec.world/en/profile/country/mar/

- https://www.moroccoworldnews.com/2020/06/307206/morocco-officializes-creation-of-economic-zone-in-fnideq-near-ceuta/

- http://www.sgg.gov.ma/Portals/1/BO/2020/BO_6894_Ar.pdf?ver=2020-06-26-190050-567

- https://www.thecitizen.co.tz/news/Kurasini-project-in-the-spotlight-after-stalling-for-7-years/1840340-5544064-guaqjhz/index.html

- https://www.theafricareport.com/27322/coronavirus-tanzanias-economy-resilient-to-pandemic-impact/

- https://anacao.cv/sao-vicente-zona-economica-maritima-especial-aprovada-por-unanimidade/

- https://oxfordbusinessgroup.com/analysis/incentivising-investment-country%E2%80%99s-first-special-economic-zone-scaling

- https://www.ship-technology.com/news/gabon-port-owendo/

- https://www.theafricareport.com/29965/moroccos-cimaf-prepares-for-clash-with-dangote-cement-in-gabon/