South Africa’s manufacturing sector showed renewed signs of strength in September, with the seasonally adjusted Absa Purchasing Managers’ Index (PMI) rising to 52.2 points from 49.5 in August. This marked the highest reading since October last year and only the second time in 2025 that the index has climbed above the 50-point threshold that separates expansion from contraction.

The improvement signals a recovery in factory activity after several months of weakness. Business activity and new sales orders sub-indices rose strongly, reflecting a rebound in domestic demand. Absa, which compiles the index, highlighted that the recovery was largely driven by local market dynamics, while global demand remained subdued.

READ ALSO: Unpacking Nigeria’s Manufacturing Success in Africa

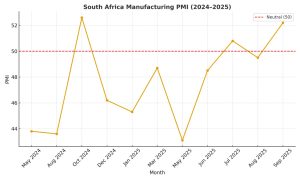

September’s expansion gains more weight when set against the sector’s recent history. South Africa’s manufacturing PMI has spent much of the last two years below the neutral 50 mark. In May 2024, it fell sharply to 43.8 amid election-related uncertainty, while December 2024 closed at 46.2 after two straight months of contraction. The start of 2025 was similarly weak, with January’s PMI down to 45.3 and March recording 48.7.

The index slumped further to 43.1 in May 2025, its lowest level of the year, before edging up to 48.5 in June. July briefly offered respite at 50.8, the first positive reading in nine months, only for activity to slip again in August at 49.5. Against this backdrop, September’s 52.2 is not just a statistical recovery but one of the strongest signals of domestic resilience seen in nearly a year.

Looking further back, South Africa’s PMI has averaged around 50.7 since 1999. The country’s record high was close to 60 in April 2021 during a post-pandemic rebound, while the lowest was just above 30 in April 2020 at the height of COVID-19 lockdowns. These extremes underline both the cyclical and vulnerable nature of the country’s manufacturing base.

The domestic market has proven to be the backbone of the September recovery. With international trade hampered by steep U.S. tariffs, sluggish global demand, and ongoing logistical bottlenecks at South African ports, manufacturers have increasingly leaned on local demand to sustain production.

The rebound in orders and business activity reflects this internal momentum, but it also highlights the uneven ground the sector is treading. Manufacturers reported longer delivery times in September, pointing to persistent infrastructural constraints and bureaucratic delays in clearing exports.

Despite the welcome rebound, caution prevails. The measure of expected business conditions over the next six months dropped sharply in September, indicating that manufacturers remain wary about the near-term outlook. Confidence in the sector also slipped in the Absa Manufacturing Survey, with sentiment down to its lowest level since early 2024.

The challenges are well known: high input costs, rising producer inflation, unreliable logistics, and fragile global demand. These risks continue to cast a shadow over the sustainability of the current recovery.

A Fragile but Welcome Rebound

South Africa’s manufacturing sector has been caught in a cycle of stop-start recoveries for much of the past two years. September’s performance is therefore significant, even if modest. It demonstrates the resilience of domestic demand in supporting factory activity at a time when global conditions remain unsettled.

For the rebound to take deeper root, structural constraints must be addressed, from port inefficiencies and power supply instability to smoother trade facilitation. The September PMI is a reminder that while the sector remains fragile, it retains the capacity for growth when conditions at home align.

For now, the mood in South Africa’s factories has shifted from contraction to cautious optimism. Whether that sentiment endures will depend on how swiftly the country can turn its recurring challenges into lasting stability.