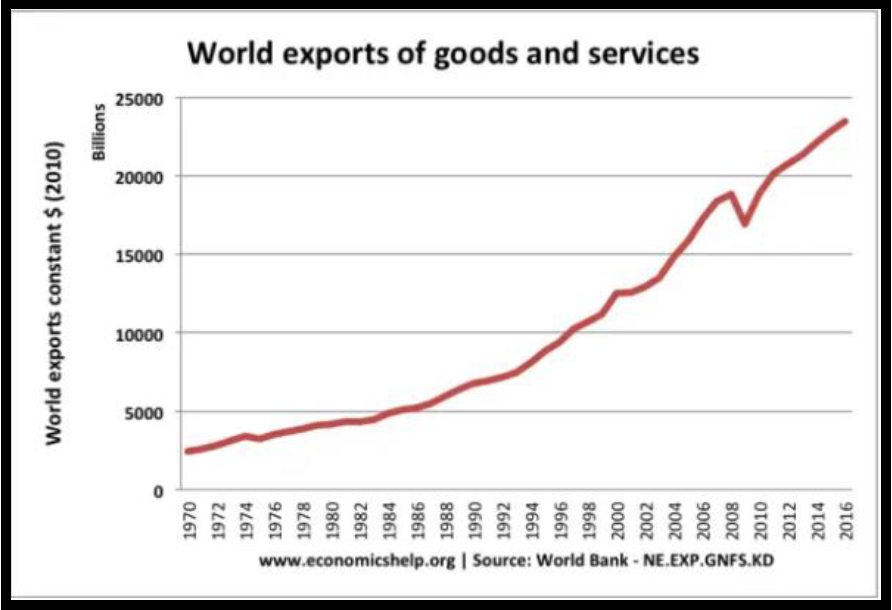

The role of foreign trade in economic growth, poverty alleviation and fostering mutual co-operation between nations cannot be overemphasized. According to the World Bank (2019), world exports of goods and services rose to USD 2.34 trillion in 2016 from about USD 0.25 trillion in 1970.

INTERNATIONAL TRADE FINANCE

Between 1960 and 2015, world exports as a % of GDP increased from 12% to around 30%.

Between 1960 and 2015, world exports as a % of GDP increased from 12% to around 30%.

Nonetheless, international trade is fraught with many challenges, of which TRADE FINANCING ranks among the major ones.

INTERNATIONAL TRADE CHALLENGES

Globalization is a common phenomenon in all countries today. While this economic phenomenon certainly ensures improved opportunities in trade, investment, financing, employment and technological advancement, it is not free from challenges.

TRADE FINANCE

Generally, exporters prefer payment in advance while importers prefer paying after reselling the products. As a result, international trade transactions experience delayed payments, which, inevitably, leads to cash flow challenges.

On one hand, the exporter may need to seek funding to produce and ship the goods before the importer pays. On the other hand, the importer may need to provide some form of guarantee that payment will be made to the exporter at a future date before the exporter produces or ships the goods.

To bridge the funding gap between the time an order is placed and the time payment is done, trade finances used to facilitate the international trade transaction. International trade financing involves the use of financial instruments and products aimed at facilitating international trade and commerce.

Broadly, trade finance includes:

– Order Financing;

– Inventory Financing;

– Structured Commodity Financing;

– Invoice Financing;

– Supply Chain Financing;

– Letters of Credit; and

– Bonds and Guarantees.

1. ECONOMIC WARFARE

Due to globalization, the world is experiencing increased polarization, and economic conflicts as major economic powers seize influence and use financial sanctions as a weapon. The Internet does not help the situation as it breaks into pieces and spreads information (particularly negative news) at lightning speed. Consequently, the international flow of money, information, products and services is slowing down.

2. GEO-POLITICIZATION

Because the United States dominates the global economy as it remains the international financial system’s hallmark, globalization can be viewed as some kind of Americanization. The information age is promoting the democratization of information and, in so doing, paving the way for demanding more information. Autocrats are now forced to care about public opinion, becoming more or less like America in the process. International trade space is being geo-politicized.

3. STATE CAPITALISM

Modern state capitalism is gripping many nations. This is segmenting the global market and destroying the uniformity expected from globalization

4. ECONOMIC RISK

International business involves economic risk such as inflation and exchange rate risks. Changes in inflation or the exchange rate of a trade partner’s country may financially harm or work to the other partner’s advantage.

5. POLITICAL RISK

Political risk is inherent in international trade. There is always a possibility of a country’s political instability reaching a breaking point or a government’s new policies adversely impacting foreign companies doing business inside its borders.

To minimize these risks, it is critical to carefully assess a potential host country’s political environment and understand its laws and leadership. The relative stability of the government largely defines the country’s political risk.

EXIM CREDIT LIMITED

Headquartered in the United Kingdom, and with a prolific regional office in Dubai, the United Arab Emirates, Exim Credit Limited has over a decade of international trade expertise.

From being a small entity established as a pilot project, the entity has overgrown expectations to become a leading international trade finance expert in the global village. Today, the entity boasts of enormous imprints in the USA, UK, Tanzania, East Africa, Saudi Arabia, Spain, Egypt, Pakistan, India, Sri Lanka, China, Malaysia, Singapore, Hong Kong, Thailand, Indonesia, Maldives, Mauritius, Philippines, South Korea, Australia, South Africa, West Africa, East Africa, Italy, Turkey, Switzerland, the Netherlands, Poland, Canada and Eastern Europe.

The success of Exim Credit Limited is driven by a team of enthusiastic, highly qualified and diverse ten-member board of directors who, among themselves, share over fifty years of expert leadership experience in banking, finance and investments management, and trade finance.

PRODUCTS

Exim Credit Limited offers a wide range of international trade finance products to facilitate foreign trade transactions and reduce the associated risks. The entity’s main products are as follows:

1. TRADE FINANCE

Exim Credit Limited provides a comprehensive approach to structuring complex trade transactions for importers and exporters. We understand that providing trade finance in contemporary volatile global markets demands creativity and flexibility.

Accordingly, we offer an array of import and export finance instruments tailored to mitigate inherent credit risks in international trade while increasing clients’ access to critical working capital.

In keeping with our mission statement, we tailor each instrument to meet the requirements of each transaction. By providing top-notch quality services to our esteemed clients, we maintain an unparalleled reputation within the international trade community.

Exim Credit Limited guides you through the different stages of your deal from the first moment of contact until the transaction is logically concluded.

The following are Exim Credit Limited’s trade finance products:

Documentary Letter of Credit – our commitment to pay the exporter in full once the exporter has submitted all the documents in line with the terms and conditions specified in the letter of credit.

Standby Letter of Credit–our commitment to pay the exporter in full once the exporter has fulfilled all the specified performance criteria in the credit letter.

Bank Guarantee–This is an irrevocable undertaking by Exim Credit Limited to pay the exporter in the event that the importer defaults on payment.

Performance Guarantee/Bond–We guarantee performance by exporters through the issuance of performance guarantees or performance bonds to importers. Performance guarantees or bonds secure the interests of the importer in the event that the exporter fails to deliver the promised goods.

Advance Payment Guarantee–Where the trade agreement provides for an advance payment and the importer has already paid the agreed percentage of the contract amount to the exporter; we guarantee repayment of this advance payment to the importer in the event that the exporter fails to fulfil their contractual obligations.

Supply Chain Finance–We use our pedigree and harmonious associations in the international trade network to connect importers with reliable exporters and vice versa.

We assist foreign traders in unlocking the working capital trapped in their supply chains by offering a set of highly customized solutions that optimize cash flow by allowing importers to lengthen their payment terms to exporters while providing the exporter’s option to get paid early. This results in a win-win situation for both importers and exporters as the importer optimizes working capital. The exporter generates additional operating cash flow, thus minimizing risk across the supply chain.

2. WORKING CAPITAL FINANCE

Exim Credit Limited offers a wide range of working capital solutions to enable its customers to fulfil their short-term financial obligations; including financing growth projects, taking on big contracts, investing in new markets and bridging cash cycle gaps.

We finance working capital through:

– Working capital loans;

– Bank overdrafts;

– Revolving credit facilities;

– Invoice financing;

– Order financing;

– Asset refinancing;

– Merchant cash advances; and

– The tax bill and VAT funding

3. EQUITY FINANCE

We have a team of qualified finance and investment experts who have an aptitude for rewarding investment strategies.

To the thinly capitalized (high-debt) but high return entity, we have the resource mobilization expertise to successfully plan and implement capital restructuring projects, including raising fresh equity from the public, angel investors, institutional investors and financial institutions.

We thrive in devising, implementing and managing bespoke financial strategies and solutions that help our clients create, grow and maximize wealth.

4. PROJECT FINANCE

We are experts in capital project appraisal, investment analysis and portfolio management. In addition to providing general investment advice, we assess the viability of proposed long-term infrastructural, industrial and commercial projects.

We then assist with project planning, structuring, and implementation to ensure that the project is financed (in the long-term) from its cash flows rather than its sponsors’ balance sheet.

We also assist with resource mobilization and, where necessary, provide either equity or debt financing at highly competitive rates to operationalize viable projects.

5. ISLAMIC FINANCIAL SERVICES

In line with Shariah Law’s dictates, we provide a wide range of financial services to the Islam community. Our Shariah Law-compliant financial services are highly customized and include unique partnership, sale, agency, and other socially responsible financial solutions different from our conventional loan-based financial services products.

INTERNATIONAL RECOGNITION

Our immense contribution to the global trade economy has not gone unnoticed. In recognition of our sterling efforts, commitment to service and provision of high-quality products, we earned the following awards:

- Best Trade Finance Company in UAE 2019/2020, from the International Business Magazine.

- Most Innovative Trade Finance Company in GCC 2020, from CFI Co. London.

- Best Trade Finance and Project Funding Advisory 2019/2020, from the Global Banking & Finance Review

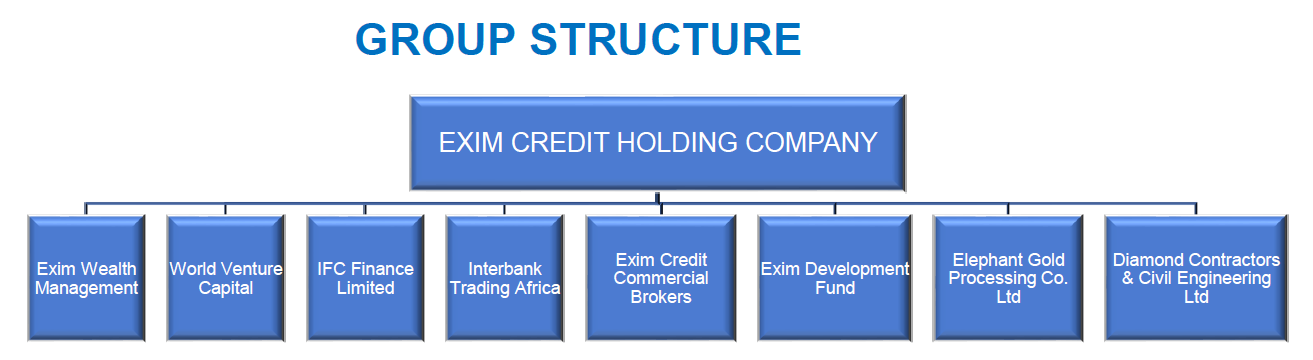

Exim Credit Limited is a holding company with eight subsidiaries.