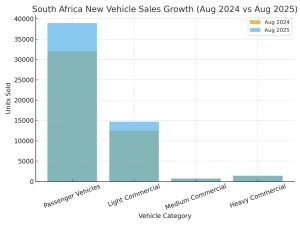

South Africa’s new-vehicle market in 2025 has moved decisively from recovery to expansion, with domestic sales now tracking to surpass pre-pandemic levels for the first time since 2019. Industry bodies and market participants attribute the upswing to a confluence of factors: stronger consumer demand for value-oriented models, loosening monetary conditions compared with 2023–24, a sharper presence of competitively priced imports and an improving macroeconomic backdrop that has bolstered household purchasing power. The auto industry association NAAMSA reported that domestic passenger vehicle registrations year-to-date to August 2025 rose to 269,351 units, an increase of 21.3% from the same period in 2024, underscoring how swiftly the market has gained momentum.

The Renaissance is not the product of a single catalytic event but the intersection of price, policy and product. Affordability has been central: a wave of lower-priced models, notably from Chinese manufacturers and newer entrants to the market, has reoriented consumer choice away from prestige badges towards tangible value propositions. NAAMSA’s manufacturer breakdown shows Toyota, Suzuki and a growing list of other brands taking substantial shares of monthly volumes, reflecting a market conditioned by cost sensitivity and pragmatic buying. At the same time, interest-rate easing through reductions totalling around 125 basis points since 2024 has reduced financing costs for buyers, while easing inflation has helped restore some real income growth and confidence, thereby lowering the hurdle for purchasing durable goods.

READ ALSO: Rwanda Leads in Sub-Saharan Africa with First Cable Car System

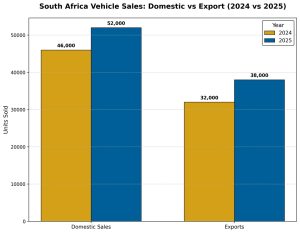

The composition of demand has shifted towards passenger vehicles and light commercial vehicles, segments that have recorded marked year-on-year increases through 2025. Passenger vehicle registrations to August climbed notably, while light commercial bakkies and mini-buses also held firm, supported by both private-owner purchases and commercial fleet renewals. Export volumes and commercial vehicle exports remain important to the industry’s balance sheet, but the domestic story is now the headline: local purchases fuelled by cheaper model ranges, competitive finance packages and targeted dealer incentives account for the vast majority of the market acceleration.

A more diverse supply chain has accompanied demand. An influx of competitively priced imports, particularly from China and, increasingly, India, has altered price dynamics at the dealership forecourt. These new entrants typically undercut incumbent brands on sticker price while offering substantive local warranties and dealer networks, forcing a recalibration of value across the market.

The result is healthier competition that has compressed price tiers and broadened the consumer base. At the same time, progressive stabilisation of global supply chains, semiconductor allocation, logistics, and shipping scheduling has improved factory output and delivery schedules relative to the acute shortages of 2020–22, reducing lead times and allowing dealers to convert stronger enquiries into sales.

Financing, Consumer Confidence and Trade Flows

Macroeconomic conditions have been instrumental. South Africa’s monetary policy pivot since 2024, with cumulative rate cuts amounting to around 125 basis points, has softened vehicle-finance rates and monthly repayments, improving affordability for marginal buyers. Concurrently, an easing in inflation has supported a modest increase in real incomes and higher consumer confidence, which together have permitted households to postpone discretionary restraint. Exports continue to play a vital role: a significant proportion of South African automotive output is destined for overseas markets, and export demand provides manufacturing capacity utilisation that supports dealer inventories and trade incentives at home. These trade linkages make the sector more resilient and better able to respond to domestic demand surges.

Incumbent Manufacturers vs Newcomers

Established original equipment manufacturers (OEMs) have responded with a twofold strategy: refreshing core model lineups while recalibrating pricing and finance offers to compete with newcomers. Toyota and Volkswagen Group remain major volume contributors, but newer marques have taken share by delivering lower entry prices and aggressive retail strategies. This competitive churn has encouraged larger OEMs to accelerate small car and entry-level model programmes aimed at recapturing cost-conscious buyers without sacrificing brand durability and residual values. The net effect is an expanded addressable market and more choice for consumers at lower price points.

Currency, Policy and Energy Constraints

Despite positive momentum, risks remain. The rand’s volatility can swiftly alter the price competitiveness of imports and the profitability of exports, feeding through to vehicle prices and manufacturer margins. Fiscal constraints and policy uncertainty, particularly around tariffs, trade policy, and incentives for local assembly, could reshape investment horizons for both domestic manufacturing and foreign entrants. Energy supply reliability is another material consideration for manufacturers operating local plants and for consumers contemplating ownership costs, especially as households factor in operating expenditure. Industry stakeholders warn that sustaining the recovery will require stable macro policy, a predictable trade environment and continued attention to logistics and energy resilience.

The Electric Question: Where EVs Fit in the Revival

Electric vehicles (EVs) are part of the medium-term conversation, but their immediate impact on South African volumes in 2025 is modest. Cost, limited charging infrastructure and supply prioritisation for higher-margin markets mean that EV uptake remains constrained relative to conventional internal combustion engine models. However, global OEM commitments to electrification, investments in battery value chains and policy signals from trading partners mean that EVs will feature increasingly in urban fleet renewals and high-income private purchases over the next five years. For now, the market’s revival is driven primarily by affordability and availability of conventional models.

The 2025 revival of South Africa’s car market is not an accident; it is the result of market adaptation to new consumer priorities, strategic responses by OEMs and a more favourable macroeconomic environment. To translate this momentum into long-term industrial benefit, stakeholders must address currency stability, policy clarity and energy reliability, and prepare for the gradual but irreversible shift toward electrification.

The immediate returns of higher volumes, broader consumer engagement and strengthened dealer pipelines present a tangible opportunity to rebuild a competitive, export-oriented automotive sector that serves both domestic needs and global market demands. The work now is to secure the gains and steer the industry from cyclical recovery to structural resilience.